- News

- In 2021, Michigan Saw 50,000 Deer-Related Crashes: Here’s How to Avoid an Accident During Peak Deer Season

In 2021, Michigan Saw 50,000 Deer-Related Crashes: Here’s How to Avoid an Accident During Peak Deer Season

According to State Farm Insurance, Michigan is the fourth highest-risk state for drivers to run into deer, elk, moose, or other critters. (West Virginia was far and away the “winner” of this contest, with Montana and South Dakota finishing in second and third positions.) According to the report, the odds of filing an animal collision-related insurance claim in Michigan are an astounding 1 in 51!And this time of year is the most dangerous of all.

According to the Michigan DNR, mating season (also known as “rut”) takes place every fall, putting deer on the move across the state; the onset of hunting season adds to that migration. In fact, it’s been said that when Michigan rifle hunters take to the state’s forests starting on opening day of the firearms deer season on November 15th, they comprise the world’s largest standing army. That may be an exaggeration, but in 2021 the state sold nearly 900,000 deer hunting licenses of various types, while in contrast, the U.S. Army fields about 480,000 active duty troops.

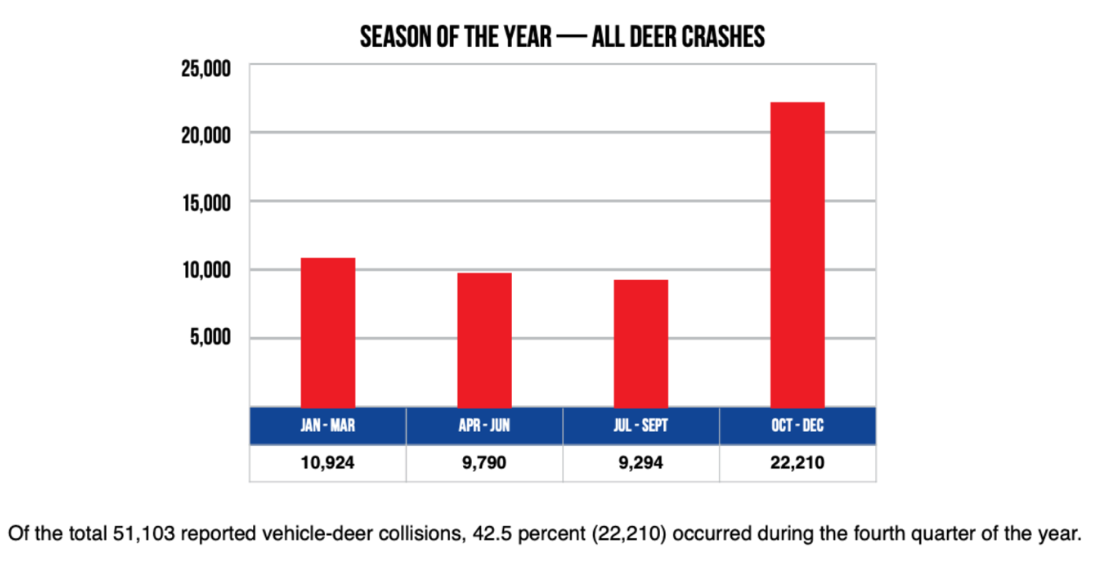

For these reasons, November is statistically the most likely month to have a deer-related collision in Michigan. With around 2 million deer traversing through the state’s forests, and so many dedicated hunters driving up north, it makes for a perfect storm of circumstances. In 2021, for instance, there were more than 50,000 collisions between motor vehicles and deer in Michigan. Oakland County saw the most collisions with more than 1,850, and Kent County came in a close second at just over 1,800.

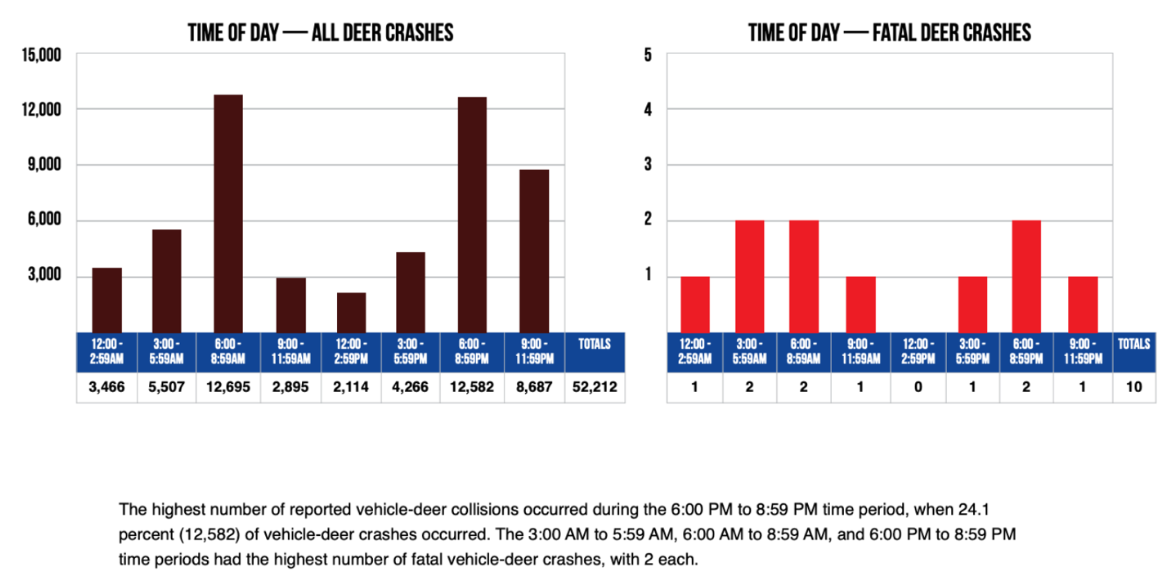

Fortunately, there were only 10 human deaths from all those events, six of which involved motorcycles. And the greatest number of accidents took place at dawn and again at dusk — with the hours of 6-9 a.m. and 6-9 p.m. seeing nearly equally high numbers of unfortunate encounters.

What Types of Injuries Occur When Cars Collide with Deer?

For the deer, injuries vary widely. Sometimes an errant deer will show no evidence a collision even took place. They’ll simply vanish into the forest seemingly uninjured. Sadly, however, many deer end up as roadkill. On the other hand, drivers and passengers are usually quite safe, even if the crash triggers an airbag deployment (although the airbags can cause some minor injuries as we noted in a recent article). Occasionally a deer will be flipped onto a car’s windshield, causing injuries to front-seat passengers, though that’s not a common occurrence.

It’s really motorcyclists who find themselves at the greatest risk of being seriously injured by running into a deer – so much that the state of Michigan offers specific advice for bikers on how to deal with this situation. Among the most helpful tips: if riding in a group, stagger your formation to reduce the likelihood other riders will be impacted if you hit a deer; brake with both wheels to reduce your speed as safely and quickly as possible; if you can’t come to a stop in time to avoid a deer, swerve in the opposite direction to avoid the deer (a choice which comes with its own risks, as we’ll discuss in a moment).

Your Best Bets to Avoid Running into a Deer

Deer are skittish and unpredictable animals, but there are some steps you can take to reduce the likelihood of hitting one with your motor vehicle. Here are a few ideas to consider:

Don’t swerve away from the deer, Michigan State Police advise. Many deer-related crashes don’t involve hitting an animal at all. Instead, drivers attempting to avoid a collision often veer away and run into trees or other vehicles – potentially causing much more serious accidents. Deer are agile and can often leap away just in time to avoid running into cars. And even if you do hit a deer with your car, it can be far less dangerous than slamming into an SUV, a semi, or tree. One exception to this rule may be motorcyclists, who are advised to veer away only if they can’t come to a stop in time to avoid hitting the deer.

Watch out for herds. Deer travel in groups and frequently move in single-file lines, so if you see a solitary doe or buck, you can be almost certain they’re accompanied by a few friends and perhaps some inattentive fawns. Whenever a deer is in sight, be prepared for a few more to emerge from cover at the roadside… and be ready to hit the brakes.

Pick a car with a “deer-repellent” color. Hunters wear blaze orange to avoid being shot by their friends in the forest. That electric neon color is a shade deer apparently can’t perceive, but humans find annoying (well, maybe just very visible). So unfortunately (or maybe fortunately when you think about it) bright orange cars are few and far between. According to experts, deer are somewhat color blind compared to humans, but they have a great ability to see motion and distinguish objects in low-light conditions. One color deer can identify is blue, so it might seem that blue cars would be less likely to be victims of an accidental deer-car incident. Some scientists also claim the color white is most visible to deer and can act as a repellent, while others say black is less easily seen, which could result in more crashes with dark-colored vehicles.

The best advice of all might be to stay off the road at high-risk times (dusk and dawn) and to be especially careful and attentive when driving from October through December (the highest-risk months).

What if I Do Hit a Deer?

Call your insurance company. Your comprehensive coverage, if you chose to purchase it, will pay for repairs to your vehicle if you hit a deer (after your deductible, of course). Although a deer-car accident might feel more like a “collision” to many drivers, Michigan’s no-fault insurance coverage considers these types of incidents eligible for comprehensive claims. So, even if you do not have collision coverage you may be able to recover the value of your car from your comprehensive coverage.

In the event your crash results in injuries, you’ll be happy to know that the Personal Injury Protection (PIP) included in your No-Fault policy will be available to help cover your medical bills. Of course, your coverage depends on the limits you’ve chosen. As you may recall from our post about how to avoid being slammed with exorbitant medical bills, we strongly recommend you elect unlimited PIP coverage. It may cost a bit more now, but it could save you from financial ruin in the future.

Another thing to know is that if you experience a deer-car collision and passengers are injured or another vehicle is involved, the same No-Fault protection applies. However, if the driver of the other vehicle is shown to be at fault, any expenses you incur beyond your insurance coverage limits may be recoverable by filing a lawsuit. Get in touch with us at 855-MIKE-WINS for details on how to proceed in that situation.

There is also a possible silver lining of being involved in an accident with a deer: if you’re into wild foods, you can apply for a salvage permit through the DNR, which allows you to collect the animal you’ve hit for your personal consumption, and you can at least make up some of the comprehensive deductible cost by loading your freezer with delicious venison. If you do decide to take home your unlucky deer, here’s a recipe for tasty Road Kill Stew you might find handy. Some good news for the deer as well — if the Sunshine Protection Act gets signed into law next year, an estimated 30,000 deer may be spared each year through later sunsets afforded by permanent daylight savings.

Enjoy Your Fall Color Tour… But Drive with Care

Besides hunting a 10-point Michigan whitetail buck, we know there are plenty of other good reasons to take to the highways this autumn, with trips to enjoy fall colors, visits to local cider mills, and even early holiday shopping providing appealing reasons to hit the roads. But whenever you’re on the road, please drive carefully. And in the event something untoward does occur, know that your “deer” friends at Mike Morse Law Firm will be ready to help you out. Just give us a call at 855-MIKE-WINS (855-645-3946) or get in touch with us here.

Content checked by Mike Morse, personal injury attorney with Mike Morse Injury Law Firm. Mike Morse is the founder of Mike Morse Law Firm, the largest personal injury law firm in Michigan. Since being founded in 1995, Mike Morse Law Firm has grown to over 200 employees, served 40,000 clients, and collected more than $1.5 billion for victims of auto, truck and motorcycle accidents. The main office is in Southfield, MI but you can also find us in Detroit, Sterling Heights and many other locations.