- News

- Workers’ Compensation Is a Mandatory Benefit: This Is How You Can Protect Yourself if Your Employer Doesn’t Have It

Workers’ Compensation Is a Mandatory Benefit: This Is How You Can Protect Yourself if Your Employer Doesn’t Have It

Workers’ Compensation Insurance (a.k.a. Workers’ Comp) can perhaps be considered the “granddaddy” of the social safety net that ultimately gave Americans such other vital benefits as Social Security, Medicare, Unemployment Insurance, and more recently the Affordable Care Act. Indeed, Workers’ Comp has protected the financial lives of Americans for generations. While sources vary on its origin, most experts note that Workers’ Comp started way back in 1911 when Wisconsin adopted the first permanent state law requiring employers to financially compensate injured workers. Similar legislation quickly spread across the country in the ensuing years, with Michigan joining the pioneering Badger State to offer Workers’ Comp beginning just a year later in 1912.

So, what does Workers’ Comp do for employees? It essentially protects much of your household income if you’re injured at work or become ill due to employment-related factors. It also pays medical bills resulting from work-related injuries or illnesses and helps cover rehabilitation costs. In Michigan, Workers’ Comp even provides funds up to $6,000 to help pay for funeral expenses if a covered worker dies on the job. But it isn’t always easy to take advantage of Workers’ Comp benefits, so we’re here to offer guidance and information we hope will be useful if you ever need it.

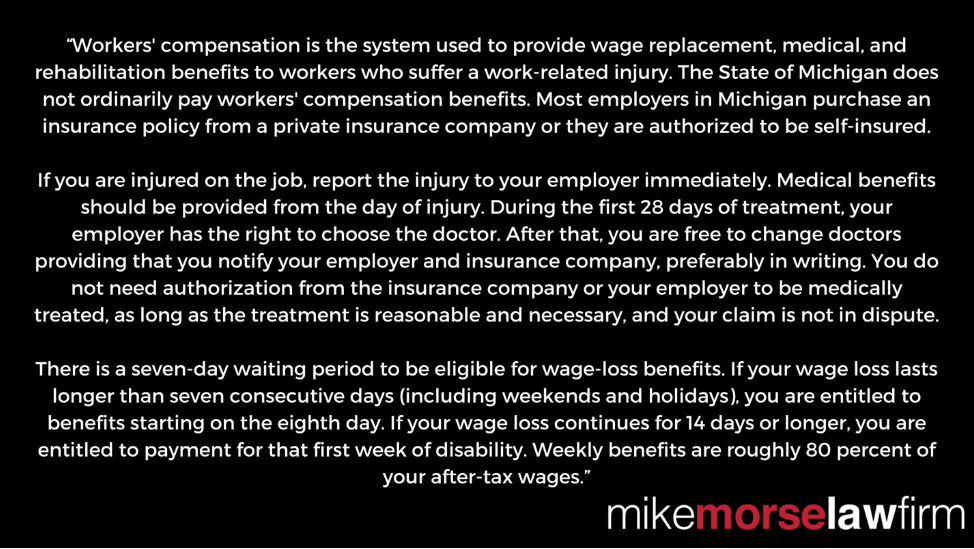

What Does Michigan’s Workers’ Comp Law Provide?

Michigan’s Department of Labor and Economic Opportunity (LEO) offers this summary of what one can expect from the state’s legally mandated Workers’ Comp rules:

This probably sounds like a good deal, and it can be quite helpful to injured workers. But you probably noticed that Workers’ Comp is not a state-run program. While employers are legally required to offer Workers’ Comp coverage to employees, and the benefits are mandated by state law, it’s essentially a form of insurance paid for by your employer — or a self-insurance plan for certain employer groups as well as companies and organizations that have qualified with state authorities.

That circumstance can lead to significant differences in how Workers’ Comp plans are administered and might result in challenges when employees file claims or attempt to obtain benefits under the terms of their employer’s policy (more on that in a moment). But regardless of those issues, the first thing to do if you’re injured at work is to contact your supervisor and Human Resources department to alert them. Then it would be wise to verify that your employer has a current Workers’ Comp plan in place by checking this statewide database listing every covered workplace. (You can also call the state’s Insurance Compliance Division at 571-284-8922 to confirm that your company has coverage.) If your employer isn’t on the list, you may have grounds for legal action and you shouldn’t hesitate to contact us immediately. Any Michigan employer with “three or more employees, or one employee working more than 35 hours per week for 13 weeks or longer” is legally required to carry Workers’ Comp coverage, though there are some exceptions to that rule.

I’ve Been Injured at Work — How Do I File a Workers’ Comp Claim?

Generally speaking, a Workers’ Comp claim will be automatically filed on your behalf once you notify your HR department. However, that isn’t always the case. If your employer fails to file a claim for you, the Department of Labor and Economic Opportunity (LEO) advises you to submit form WC-117, which they will forward to the appropriate recipients to expedite your claim. Doing so will also establish documentation that could come in handy later on — so be sure to keep a copy of the completed form for your records. To fill out the form, you’ll need to include details on your injury and how it occurred, as well as your employer’s name, address, and other relevant employment information.

You should report any injury that occurs at work, regardless of how minor you may think it is. Injuries or illnesses can become more severe over time, and if you wait too long to file a claim, you could be left without options. In short, time is of the essence. Specifically, LEO advises workers of the following rules:

“You have up to two years from the date of injury, or the date the disability manifests itself, to bring a workers’ compensation claim. If you submit a claim after two years, Section 381(2) provides that in those cases the worker cannot receive past due benefits for more than two years back from the date he or she filed an application for hearing. However, the statute also states that the employee should provide notice of injury to the employer within 90 days of the injury. It cannot be stressed enough that you should report any accident at work, however minor, to your employer immediately to prevent possible delay or dispute of your claim.”

How Much Money Can I Receive to Make Up for Lost Wages?

You may be disappointed to learn that you likely won’t get your full pay from Workers’ Comp. Typically, you’ll receive a portion of your regular salary or paycheck, because the benefit is capped at 90 percent of the “State Average Weekly Wage” which in 2023 is $1,216. In other words, the most you’ll receive from Workers’ Comp to make up for lost wages will be $1,095 per week this year (which is 90 percent of $1,216). If that’s a significant reduction in your usual pay, we might be able to help you receive additional funds through legal means by approaching your employer and/or its insurance company to make a case on your behalf. As always, we’re available at 855-MIKE-WINS (855-645-3946) to answer your questions about this type of situation.

What if I’m Injured Off-Site?

As a recent USA Today article explains, whenever you’re “on the clock” (meaning you are performing an employment-related task for your employer) you should be covered by Workers’ Comp even if you’re working at home or from another remote location. Employees who don’t report to specific job sites – for instance truck drivers, outside sales representatives, traveling nurses, plumbers, electrical contractors and more – are also covered under their employers’ Workers’ Comp plans regardless of their physical locations while on the job.

What Happens if My Employer or Their Workers’ Comp Provider Denies My Claim?

The good folks at Michigan’s Department of Labor and Economic Opportunity will attempt to assist you if this happens. But you’ll need to request their help in writing by submitting a mediation request using form WC-104A. This form asks for much of the information you’ve already provided on form WC-117 (which we mentioned above), but includes further details on any medical costs you’ve incurred resulting from your injury, wages you’ve lost, the names and ages of your dependents, a detailed list of clinics and hospitals where you’ve received treatment, and the names and contact information of medical providers you’ve consulted. At this point, you should seriously also consider calling a lawyer who specializes in Workers’ Comp cases so you can have professional legal support backing you up through the mediation and hearing process. Once again, it’s important to stress that our firm can provide this assistance at no cost to you.

What Organizations Aren’t Required to Offer Workers’ Comp?

A surprising variety of organizations and businesses are exempt from the Michigan Workers’ Comp requirement. Among them are farms (unless they have three or more employees working 35 hours a week for 13 weeks), sole proprietors who are considered self-employed (but if they hire any employees, they’ll need to provide them with coverage), and independent contractors (this includes such folks as accountants, realtors, freelancers, housekeepers, and even veterinarians, doctors or dentists if they are working independently). Despite these exemptions, most Michigan businesses are required to provide Workers’ Comp protection to employees, as are all governmental entities and school districts.

Can I Lose My Job for Filing a Workers’ Comp Claim?

This is a bit of a “Catch-22” because the Workers’ Comp law prohibits employers from targeting you for termination if you report an injury. However, Michigan is also an “at-will” state, which means employers don’t have to provide any reason for firing a worker. Additionally, while you’re out sick your employer might need to hire someone else to take over your responsibilities, and companies can legally do so to protect their interests. Of course, if you’re a solid employee, you’d expect your employer to reciprocate by allowing you to recover and return to work when you’re back on your feet. If you lose your job while you’re out on Workers’ Comp, we strongly recommend you contact us to discuss the particulars and to see if you have a case that merits legal action.

What Can I Do if My Employer Violates Workers’ Comp Laws?

We have a team of attorneys and staff that routinely handle workers’ compensation cases and can hold your employer accountable without costing you a penny. You shouldn’t ever hesitate to file an honest Workers’ Comp claim in Michigan. You’re also protected by the state’s no-fault rules that specify Workers’ Comp benefits must be paid to injured workers regardless of who’s at fault. Call us at 855-MIKE-WINS (855-645-3946) if you have any questions about your rights concerning Workers’ Comp coverage in Michigan. We’re always here for you – day or night, seven days a week, 365 days a year.

Content checked by Mike Morse, personal injury attorney with Mike Morse Injury Law Firm. Mike Morse is the founder of Mike Morse Law Firm, the largest personal injury law firm in Michigan. Since being founded in 1995, Mike Morse Law Firm has grown to over 200 employees, served 40,000 clients, and collected more than $1.5 billion for victims of auto, truck and motorcycle accidents. The main office is in Southfield, MI but you can also find us in Detroit, Sterling Heights and many other locations.