Are No-Fault Benefits and Car Accident Settlements Taxable?

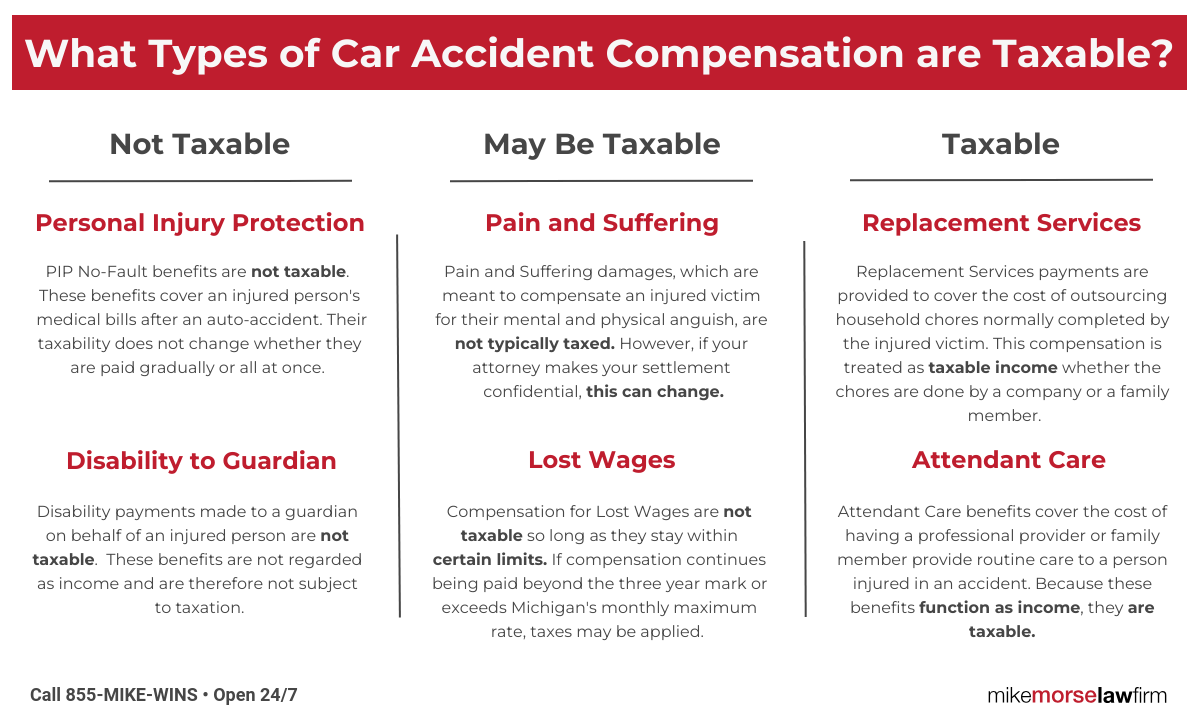

While most payments made to an injured person after a car accident are not subject to taxation, many of the associated benefits that accident victims rely on are taxable. In Michigan, the taxability of each type of compensation is largely dependent on whether it is seen as income. Any benefits that are treated as income will be taxed like income, with some exceptions.

Are Pain and Suffering Settlements After a Car Accident Taxable?

Pain and suffering damages, which can be recovered for a victim’s physical and mental anguish after a car accident, are not typically taxable. However, if your attorney makes your settlement confidential this may not be true. It should also be noted that Michigan laws are subject to change, and it is always best to talk to a CPA or other advisor during a lawsuit.

Is Personal Injury Protection (PIP) Taxable?

Personal Injury Protection, the part of No-Fault coverage that pays for your medical benefits, is not taxable. It doesn’t matter if the payments are made gradually or all at once as overdue benefits, PIP is tax free.

Are No-Fault Attendant Care Benefits Taxable?

No-Fault attendant care benefits provide payment meant for the person taking care of an injured car accident victim to compensate them for their time and labor. Because these benefits are considered income, they are taxable. Like PIP, it doesn’t matter if these benefits are collected over time to pay for attendant care services or all at once. Even if the attendant being paid is a family member, the income is still taxable. However, these benefits may be exempted from FICA and FUTA taxes.

It should be noted, however, that some CPAs and Tax attorneys do not believe that attendant care benefits should be treated as income. If you are an attendant care provider, your best course of action is likely to talk to an advisor that you trust.

Are No-Fault Replacement Services Payments Taxable?

Replacement services benefits are No-Fault payments meant to help accident victims pay for the everyday chores they can no longer complete that must be outsourced to either a service or other family member. These benefits are taxable though they may not be subject to FICA and FUTA taxes. It does not matter if these payments are made regularly, all at once, or achieved through a trial, they are still taxable.

Is Payment for Lost Wages Taxable?

Payment for lost wages, which can be claimed for up to three years after a car accident, are not taxable. They are, however, reduced to only 85% of the income the victim would have made. Those who are likely to remain incapacitated for longer than three years and your attorney claims excess wage loss, any further settlement will be taxed as income. Additionally, if your lost wages exceed the monthly maximum ($6,065 in 2022, with an increase every October), the amount above the maximum will be taxed.

Are Disability Payments to a Guardian Taxable?

Disability payments received by a guardian on behalf of a person injured in a car accident are not treated as income and are not taxable.

Injured in a Car Accident? Call the Mike More Law Firm.

Car accidents can be painful and confusing. At the Mike Morse Law Firm, we have experience dealing with the intricacies of Michigan No-Fault law and fighting big auto-insurance companies. We work hard to help our clients through this difficult and frustrating process and make sure they get the benefits they deserve. Call us at 855-Mike-Wins (855-645-3946) or contact us through our website for a free consultation.